A Biased View of Payment Solutions

Table of ContentsMerchant Account Things To Know Before You BuyLittle Known Facts About Payment Processor.The Ultimate Guide To EcommerceEverything about EcommerceAll About Payment ProcessingThe Main Principles Of Merchant Account How Payment Solutions can Save You Time, Stress, and Money.

This is primarily a prebuilt gateway that can be personalized as well as branded as your very own. online payment systems. Here are some well-known white label services created for sellers: An incorporated portal can be a dedicated source of income, as merchants that acquire all the necessary compliance become payment service providers themselves. This implies your organization can process settlements for other sellers for a charge.

Here are some points to take into consideration before choosing a carrier. Research the prices Payment processing is complex, as it consists of a number of financial establishments or companies. Like any type of service, a settlement entrance needs a fee for making use of third-party tools to procedure as well as accredit the deal. Every party that takes part in settlement verification/authorization or processing costs charges.

The Of Card Processing

Every settlement service company has its own terms of usage and also fees. Normally, you will have the following cost kinds: portal arrangement charge, regular monthly gateway fee, seller account arrangement, as well as a fee for each and every purchase processed. Read all the rates documents to prevent hidden costs or extra costs. Examine deal restrictions for an offered provider While costs as well as installment costs are inescapable, there is one point that might figure out whether you can deal with a particular company.

Guarantee your product kind is allowed by the service provider Usually, there are two kinds of items considered by companies: electronic and physical. Some of the payment service companies supply their services both for physical as well as electronic products. It's not uncommon for only one kind of item to be available in usage of a certain system.

Popular repayment portal suppliers The crowd of portal service providers is overwhelming, so we have actually selected some of the greatest, most dependable choices. Table of repayment entrance service providers features Red stripe Red stripe is an e, Business tailored-payment option. Red stripe accepts all significant repayment methods, consisting of mobile settlement suppliers such as Apple Pay, We, Chat Pay, Alipay, and Android Pay.

The Ultimate Guide To Payment Checkup

Pay, Pal Pay, Friend is one of one of the most widely approved digital payment techniques in the world. Pay, Friend provides scalable solutions for businesses of different dimensions. Via its entrance, Pay, Pal uses handling of all the major credit scores and also debit cards, as well as Pay, Friend settlements themselves, with various other approaches.

This is a protection step when we change delicate information with symbols as it decreases the possibility of scams. Symbols have deal information as well as cardholder details, without revealing it to the 3rd parties. End up being PCI DSS compliant by carrying out all the essential protection procedures and incorporating seller fraudulence defense devices on your web site.

g. Apple Pay), you'll need to incorporate them individually with their APIs. Establish a merchant management internet application, or simply an admin panel to allow your team to manage vendor operations. You may also make use of open-source payment portal options. It is possible to use an open-source repayment gateway (like Omni, Pay, Pay, U, or Active Seller) software program that will certainly lower the costs of the design.

The Basic Principles Of Payment Solution

And also if you are searching for a method to boost customer self-confidence, integrate a payment option that will certainly motivate trust fund, support several repayment techniques, and also be shielded from fraudulent actions.

FAQs What Is a Repayment Entrance? At its core, a payment entrance is software application that secures a client's charge card info as well as sends it to the providing bank for approval when they make a purchase online or in a store. This transaction identifies whether a client's purchase is authorized or decreased.

If the deal is authorized, the vendor then satisfies the order. The procedure usually takes simply seconds. Safety and security is essential to settlement entrances. payment processor. If clients do not really feel that they can trust the vendor taking their repayment information, they might make a decision not to make an acquisition. Just How Much Do Settlement Entrances Cost? A lot of repayment gateways supply purchase-based prices, with 2.

Fascination About Merchant Account

Because deal rates can vary, it is necessary for sellers to select both a seller account and payment gateway that provides prices that won't reduce right into their earnings margins. Just how We Picked the Best Payment Gateways We looked at over sage payment processing a lots repayment entrances for this evaluation. On top of our checklist were companies that used assistance for the most repayment types.

Today we make use of mobile phones, not just for sending out messages or obtaining telephone calls but likewise for purchasing product and services and spending for them. Statista report that by 2022, the deal worth of mobile settlement applications will reach virtually $14 trillion, highlighting the why not check here busy market. Whether you intend to develop a booking, event, or perhaps a shopping application to procedure purchases you will certainly need a mobile app payment portal.

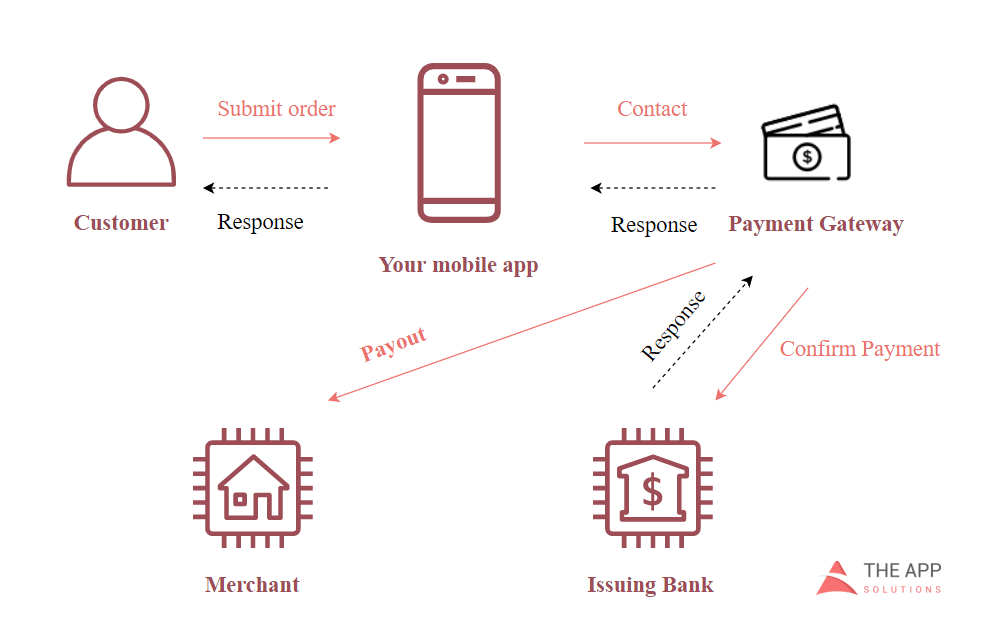

Initially of all, allow's see how the mobile app repayment portal works. When you get a new pair of tennis shoes or order pizza, either the application or site offers you the choice to perform an online repayment by means of a built-in repayment portal.

How Payment Solution can Save You Time, Stress, and Money.

[In-app repayments process] All these stages take just a couple of secs if the Web connection is good. Currently you can visualize what is taking place when you pay for your orders online. At the same time, you additionally see a clear image of exactly how vital settlement entrance protection is. Every second, a massive quantity of money and also repayment details undergo payment gateways.

By making use of In-App Billing API, you make it possible for individuals to pay in-app with their App, Store or Google Play through Apple or Gmail accounts. When you are marketing product or services outside the application, both Apple as well as Google advise utilizing third-party mobile settlement portal carriers. You can integrate SDK as one of the existing in-app settlement services to your app that will carry out all purchases with banks, safe and secure customer information, and be accountable for payment deals.

To equip your app with this function, make use of the SDK of existing payment entrances, such as Pay, Chum, Braintree, or Red stripe. check my site You can integrate the SDK by yourself or hire an advancement group that will do all the integrations as well as setups for you. Relevant articles:.

Payment Solution Can Be Fun For Everyone

"Non-cash payments have actually increased in quantity due to the increase in fostering of electronic settlement services across all market sectors," Christophe Vergne, cards as well as payment method leader at Capgemini, told CNBC. The following fintech settlement business are adding to this expanding pattern while making handling repayments faster, less complex and extra safe and secure.

Billd Austin, TX Billd is a repayment solution for the building and construction industry that permits professionals to acquire the materials they require to complete a work and also pay distributors over a time period. Suppliers are paid in advance by Billd prior to shipping any items to specialists while building contractors have a 120-day term to pay their equilibrium, making it so cashflow never obstructs of approving remarkable tasks.